does mississippi pay state taxes

But since Mississippi does not require retirees to pay state income tax on qualified income the money in your 401k is never subject to state-level taxes if you retire in the state. You can make electronic payments for all tax types in TAP even if you file a paper return.

Mississippi Governor Signs State S Largest Income Tax Cut

Counties cities transit and special purpose districts have the option to impose additional local sales and use taxes.

. Unlike the Federal Income Tax Mississippis state income tax does not provide. The median property tax in Mississippi is 50800 per year052 of a propertys assesed fair market value as property tax per year. SUI rates in Mississippi range from 0 to 54.

The tax rates are as follows. 4 on the next 5000 of taxable income. Mississippi has one of the.

3 on the next 1000 of taxable income. Income sources that are exempt from state taxes include Social Security retirement benefits. If filing a combined.

Bar Graph Showing That In States. The Mississippi state tax rate is graduated and are the same for individual filers as well as businesses. An instructional video is available on TAP.

The state does not tax Social Security benefits income from public or private pensions or withdrawals from retirement accounts. The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi. All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax 7 unless the law exempts the item or provides a reduced rate.

Tax amount varies by county. Mississippi is very tax-friendly for retirees. Mississippis sales tax rate consists of a state tax 7 percent and local tax 007 percent.

What are my state payroll tax obligations. Cre dit Card or E-Check Payments. Mississippi has a 900 percent state sales tax rate a maximum local sales tax rate of 100 percent and a.

The taxable wage base in Mississippi is 14000. Illinois 183 billion relief package includes income and property tax rebates that should be going out through November. The State Sales Use tax rate in Mississippi is 7.

The state of Mississippi levies Sales use tax on tangible goods services provided by an LLC. This website provides information about the various. These local taxes bring the.

Mississippi requires employers to withhold income taxes from employee paychecks in addition to employer paid unemployment taxes. 5 on all taxable income over 10000. 0 on the first 2000 of taxable income.

Your corporation will owe Mississippi corporate income tax in the amount of 19820 3 of amount from 1000 5000 plus 4 of next 5000 plus 5 of remaining 390000. Mississippi collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Mississippi has a combined state and local sales tax rate of 707 percent.

Pay by credit card or. Mississippi has some of the most generous exemptions for retirement income of any US. You can use this service to quickly and securely pay your Mississippi taxes using a credit card debit card or.

Mississippi collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Other things to know about Mississippi state taxes. How Much Should You Pay in Mississippi State Tax.

A catastrophe savings account is a tax advantaged regular savings account or money market account established by a Mississippi resident after January 1 2015 at a financial institution to. Individuals who earned less than 200000 in. 0 on the first 4000 of taxable income.

Welcome to the online Mississippi Tax QuickPay for Businesses and Individuals. Mississippi has a state sales tax rate of 7. Mississippi has a 700 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 707 percent.

Still the state does impose Social Security and Unemployment Insurance SUI on employees.

Philip Gunn S Plan To Cut Mississippi Income Taxes Ready For Vote

Mississippi Governor Signs State S Largest Income Tax Cut Mississippi S Best Community Newspaper Mississippi S Best Community Newspaper

Speaker Gunn Wants To Slash State Taxes He Also Wants To Create A New Tax In Clinton State Government Djournal Com

State Corporate Income Tax Rates And Brackets Tax Foundation

Reeves In State Of The State Raise Teacher Pay Cut Taxes

State Individual Income Tax Rates And Brackets Tax Foundation

Cost Of Living In Purvis Mississippi Taxes And Housing Costs

Mississippi Retirement Taxes And Economic Factors To Consider

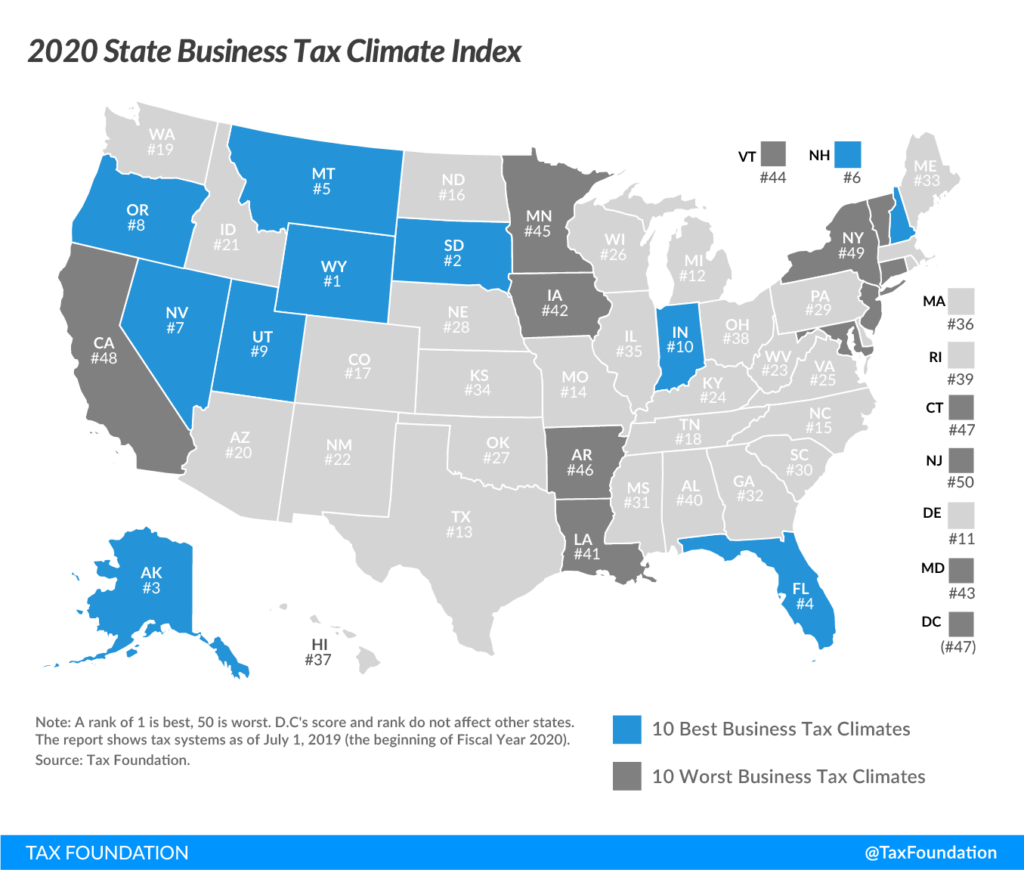

Mississippi S Tax Climate Rated 31st Mississippi Center For Public Policy

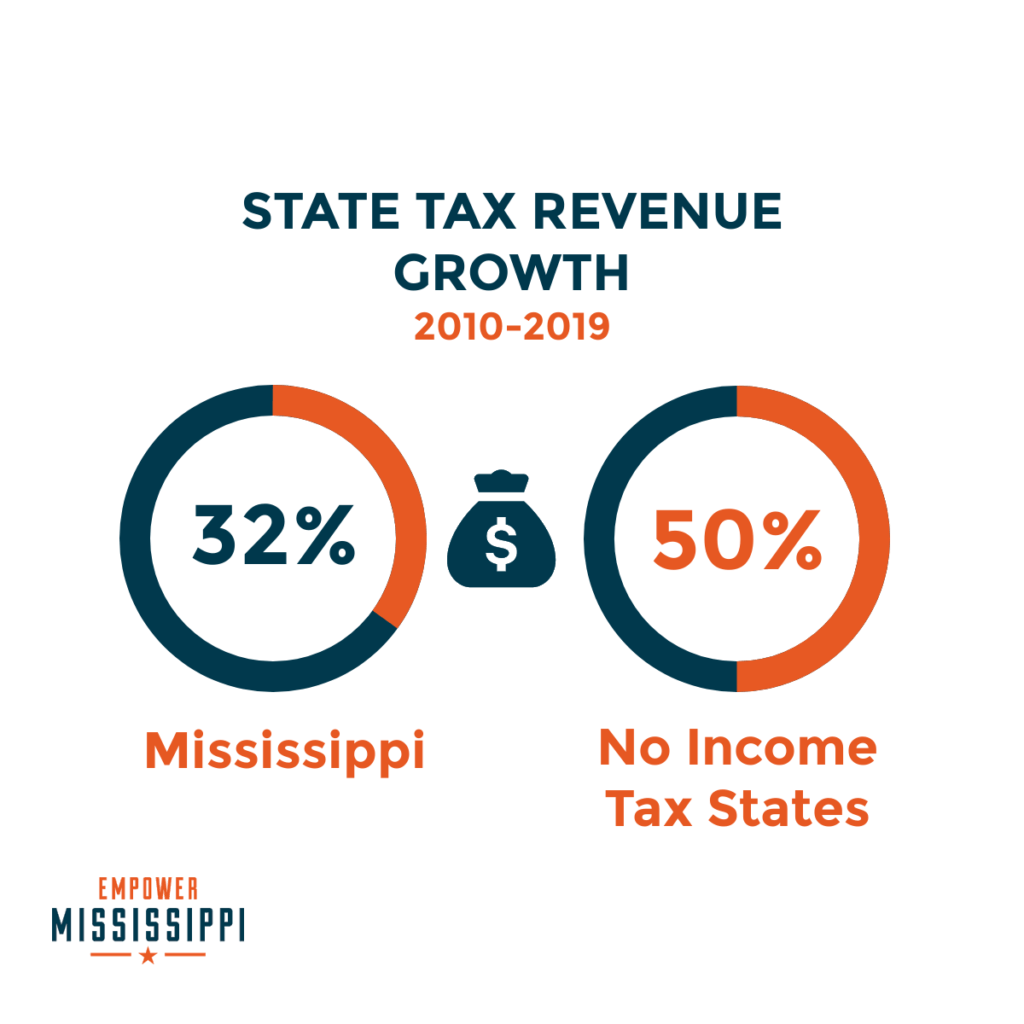

But How Will We Fund Government Without Income Taxes

Tennessee Exempted Taxes On Food Mississippi Exempted Taxes On Guns Mississippi Today

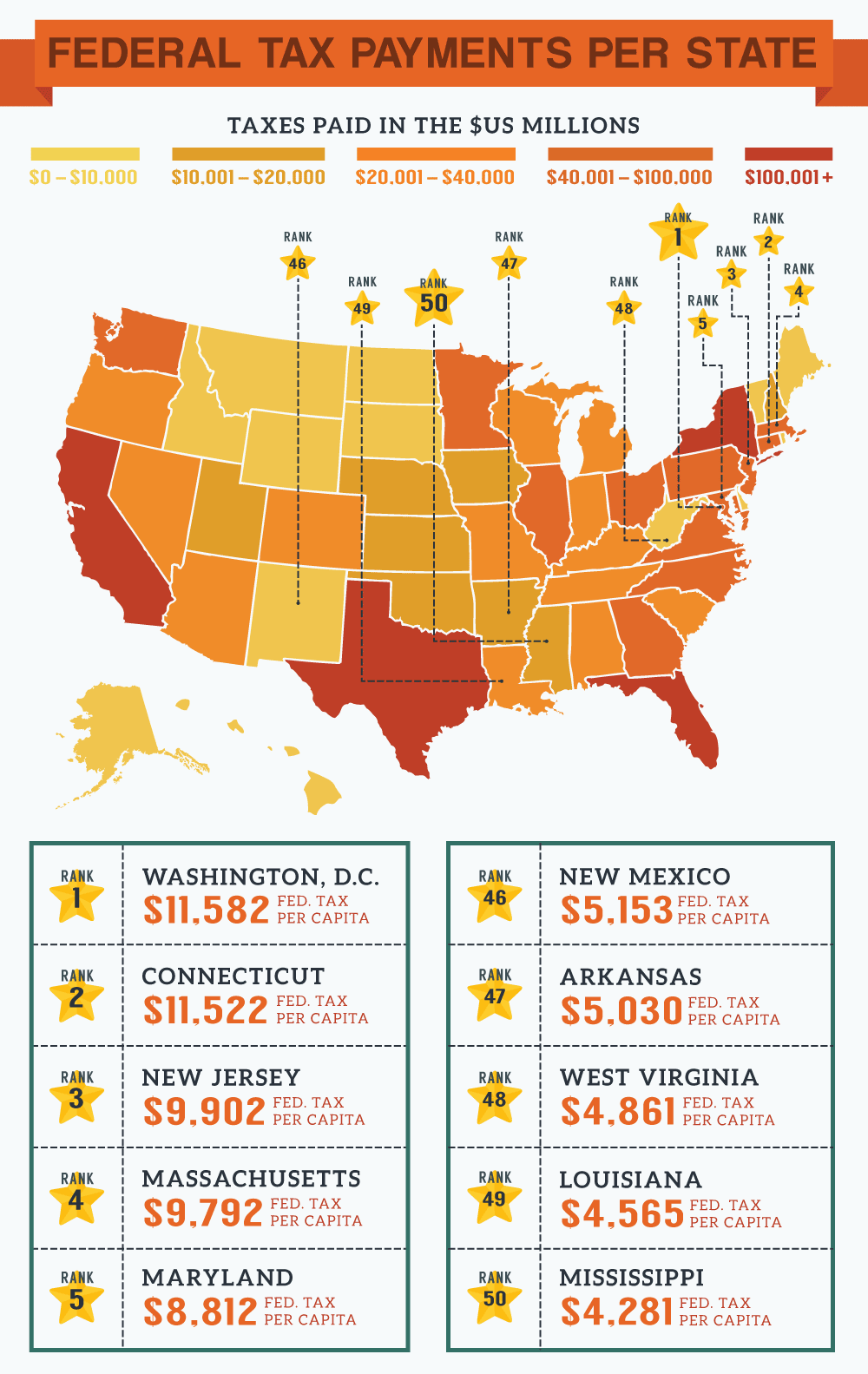

United States Federal Tax Dollars Creditloan Com

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

File Ms Taxes With Dept Of Revenue E File Com

Mississippi Income Tax Reform Details Evaluation Tax Foundation

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

These Are The States Where 100 Goes The Farthest

Mississippi Governor Signs State S Largest Income Tax Cut The Seattle Times